Bringing Consciousness to Your Finances

Consciousness and finances are not terms you usually associate together but, when they are, it can be a powerful way of transforming your finances and increasing your happiness. This article will help you understand how bringing consciousness to your finances can help move you towards more happiness.

Table of Contents

- What is Consciousness?

- What Financial Consciousness is NOT

- Why Financial Consciousness is Important

- Establishing your Net Worth

- Daily tracking of income and expenses

- Weekly Wrap-up

- A wider perspective

- Assess and adjust

- The shift in mind set

- Conclusion

What is Consciousness?

Let’s start with what “consciousness” means. Consciousness at a basic level is to have a deep knowing quality. When you bring consciousness to personal finances, it means you get a deep knowledge of them.

How exactly do you do this? In order to be conscious of something you first need to develop an awareness of it. After all, if you aren’t aware of something, how can you know it?

So, bringing consciousness to your finances is about getting to know your personal finances deeply and intimately by first becoming aware of them.

What Financial Consciousness is NOT

To help understand what bringing consciousness to your finances looks like, let’s use an example of what NOT doing so might look like.

Let’s start with a fictional neighbour, Jackie. Jackie buys a lot of stuff, but she doesn’t usually apply much thought or research before buying anything. She gets what she wants or needs basically on impulse or from previous purchasing habits.

As a result, Jackie doesn’t always end up with the best value, or necessarily even buy what she really wanted. This leads to wasted time and money as well as wasted or unused purchases.

After she has bought her latest thing, Jackie doesn’t bother keeping her receipt or record her purchase anywhere for future reference. She doesn’t evaluate her purchase in any way to see if it was the best choice, or if it should be returned or exchanged.

The stuff she buys piles up somewhere in her home until it becomes overwhelming. She finds no joy in what she has; all of her purchases have become a burden to her, taking up space physically and mentally. They are energy drains.

Many of her purchases are put on credit cards or her Line of Credit. She makes the necessary monthly payments on them without checking the transactions on her statement, and she never looks at the total balance owing or the interest she pays each month. She gets too stressed when she does.

In this way, Jackie goes through her days collecting and consuming stuff, possibly accumulating debt while she does, or at the very least not saving any money.

Her days go by without any real plan or focus concerning how she wants her personal finances to unfold. She doesn’t have any self-responsibility concerning her finances, leaving it all to chance. Basically, she is not conscious of her finances.

This is a “hope for the best” approach, and can be a recipe for financial disaster.

The good news for you is that you’re already aware! The fact that you’re reading this post means that you’re already ahead of so many people who haven’t yet realized that their finances and their happiness are intimately related. Some people live their whole lives without ever learning how to use their financial situation to move towards happiness.

Why Financial Consciousness is Important

Let’s face it: finances affect every aspect of life. It’s not necessarily about the amount of money people have, but how they use that money. Some people have very fulfilling lives with very little money, while others are unable to find happiness no matter how much financial abundance they have.

You need to know how much money you have, and how to use it in a way that moves you towards happiness and a fulfilling life.

This is financial consciousness.

Establishing your Net Worth

No, this isn’t about assessing your value as a human being and what you provide to the world; that is immeasurable! However, your financial net worth is measurable.

This is determining what you would have left over if you sold everything you had and then paid off your debt. Your net worth gives a measurable result to your economic activity.

1. Make Two Lists

First, you’ll need to write two lists: what you own and what you owe. As examples, you might own a home, some furniture, a car or two, possibly some jewellery. You may also have a life insurance policy, a business, investments, money in bank accounts, etc.

As to what you owe, maybe you have a mortgage, credit cards or Line of Credit. Perhaps you have personal loans, student loans or owe money on income tax.

Take your time making these lists.

A quick warning: establishing your net worth can bring up many unwanted emotions, especially if you’ve never done it before. You may feel regret, guilt or even fear; this can be a scary process, and that is completely normal.

Try not to get caught up in your emotions, thinking about what you “should have” done and double-guessing old decisions; that’s not the purpose of this process, and can easily side-track you.

2. Establish Value

Once you have everything that you both own and owe listed, you need to determine an actual dollar amount for each item. The things you own need to have a value placed on them. Likewise, each amount you owe needs to be established.

You can do this in two ways. You can do it arbitrarily based on what you believe they’re worth, or you can use someone who would be more familiar and could determine their true value, such as a real estate agent, a jewellery appraiser, etc. The more accurate you can be, the better for ensuring the highest level of awareness of your finances.

3. Determine your Net Worth

At the end of the day, when you add up the value of everything you own and then subtract from that everything you owe, the remaining amount will be either positive or negative. The former (a positive balance) is what you want in order to move towards being financially happy and secure.

By establishing your net worth, you’re now aware of what your personal financial situation is, whether good or bad.

Daily tracking of income and expenses

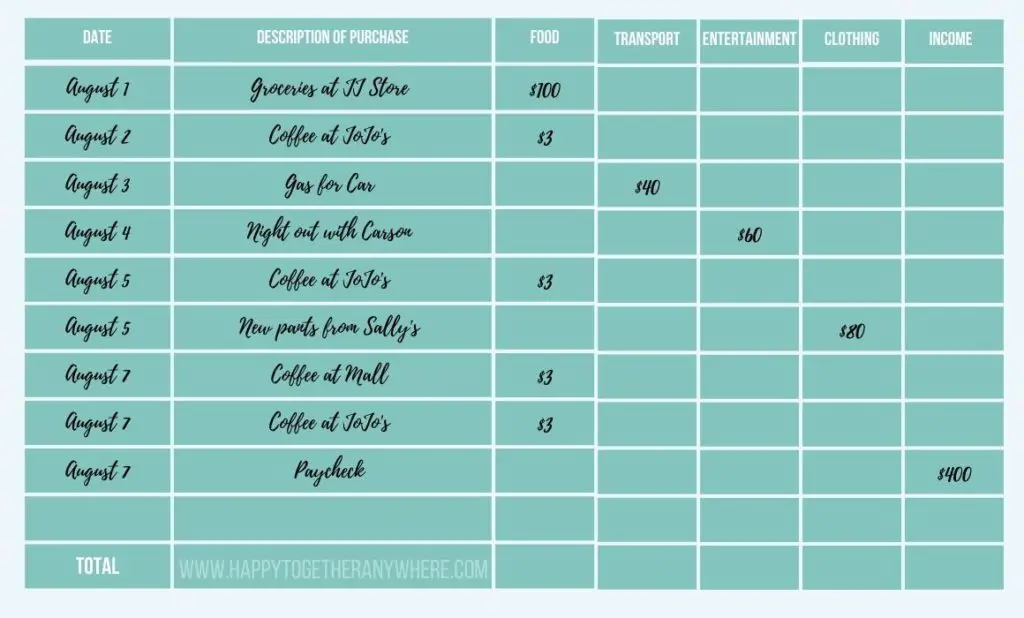

The next step in your journey to financial awareness is becoming aware of your personal finances on a day-to-day basis. This will involve tracking your income and expenses every day. You can do this on a spreadsheet or just a simple notebook; whatever works for you.

Whatever tracking method you choose, you’ll need to have categories to organize your notes. Some common categories are:

- Income: paycheck, gifts, tax refund, lotto winnings etc

- Food/Household: groceries, toiletries, eating out, coffee, etc

- Transportation: car payment, license, insurance, gas, taxi, bus, etc

- Housing: rent/mortgage, repairs, lease, etc

- Entertainment: drinking, night out, movie, cigarettes, etc

Exactly how you organize your categories is personal; you may choose to put coffee and eating out in “entertainment” rather than “food”. Don’t get too caught up in what goes exactly where; in the beginning, the important thing is that everything is recorded somewhere.

As you become familiar with this process, you may want to either narrow down categories or expand them. For example, you might create a new category for “junk food” and move bags of chips, chocolate bars, and corner-store donuts from the “grocery” category to the new one.

This is an excellent way of increasing your awareness of exactly where your money goes (and being able to determine if it’s bringing you enough joy to be “worth” the money it costs you).

This tracking process will provide you with the details of how much money comes in and exactly where it goes. Every debit card transaction, credit card transaction, cash payment, automatic withdrawal, direct deposit, cheque, cash payment, gift, etc., no matter how trivial, has to be written down.

Everything needs to be recorded to have an accurate reflection of, and awareness of, three things:

- how much money comes to you

- how much of it you spend

- what you spend it on

This daily tracking of your income and expenses serves four important purposes.

(1) First, the process of physically recording each transaction brings it to your attention, so you are aware of it in the moment you record it.

(2) Secondly, it helps organize information for you to review at a later point. This allows you to bring consciousness to that moment using the information you’ve collected.

(3) Third, it gives you the foundation from which you can move on to the next level of bringing consciousness to your finances. Here you become aware of how your purchases can affect your happiness, and use that to move towards feeling happier more often (more on that in a bit).

(4) Lastly, it helps create a habit you will continue. This habit helps solidify your forward movement in bringing consciousness to your finances.

Weekly Wrap-up

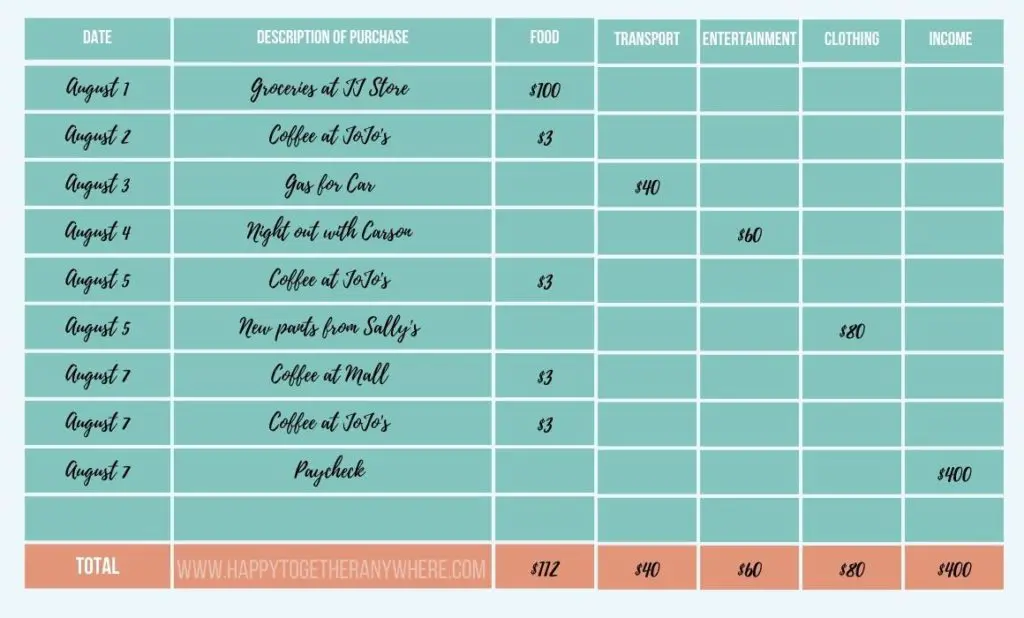

Your next step is the weekly wrap-up. At the end of each week, you add up the totals for each of the categories in which you recorded transactions.

At this point you have:

- a record of each daily transaction

- the cost of each item

- a brief description of each item

- a category for each item

- a total you spend in each category, and

- a total of each of your income sources.

Now you total each column: both the income categories and the expense categories. In the above example, income = $400, expenses = $292.

Deduct the total expenses from the total income (ie/ $400 – $292 = $108)

This leaves you with a balance for the week of either what you have saved (a positive amount) or how much more you spent than earned (a negative amount). In the above example, $108 was saved in that week.

Simply as a result of recording your “daily life” transactions, you’re now aware of how much you earned, how much you spent, where it went and whether you are saving any money or not.

A wider perspective

The next level of bringing consciousness to your finances is to extend this same process out to a full month. It will produce the same result, but over a wider time frame. This helps to identify financial trends and anomalies that occur throughout a longer period of your life.

The weekly perspective has value in that it allows you to assess and make adjustments to your finances more quickly. Because you’re more immediately aware of where you are financially, you can make any needed changes without too much time passing.

A monthly perspective is a longer period of time to review past activities. This means there is a longer waiting period before changes can be made that affect your finances; it takes more time to impact your finances positively or negatively.

At this point, maybe you’re thinking, “This is all too much work! I don’t really want to be this aware of my personal finances! I just want to go about my day, and be happy doing what I do.”

But that’s exactly the point.

You need the awareness of what you are doing day to day, which happens by recording “doing what I do”. Without it, you can’t assess and determine how much happiness these things actually provide. You need to bring consciousness to your days to ensure you are moving in the direction of happiness.

By bringing consciousness to your finances, you can see which financial actions bring you towards happiness or away from happiness.

Assess and adjust

When it comes to bringing consciousness to your finances, this is really where all your hard work pays off. In this last step, you learn how to determine which transactions are truly bringing you happiness.

This is not to say that “money can buy you happiness”. But you can use money in one of two ways:

(1) It can be used to purchase things and experiences that cause you to move towards happiness, or

(2) It can be wasted on purchases and experiences that have not been consciously chosen, so may provide a neutral or unsatisfactory feeling or even move you towards unhappiness.

To assess and adjust, you evaluate each category of income and expenses to determine whether you need to increase, decrease or keep the level of each category where it is as a means of moving towards a higher level of happiness.

To do this, you review each transaction in each category and rate the level of happiness you received from each. You think back to the transaction as it occurred and rate the level of happiness, unhappiness or neutrality you had from it. You then decide whether you want more, less or an equal amount of this going forward.

Let’s pretend. Look at the example we used above for the weekly transactions recorded, and pretend that this is your weekly record. You examine it and notice that there are many coffee purchases.

What were the circumstances around these coffee runs?

Were they mindless run and grabs caused by boredom or exhaustion, where you desperately needed a boost to get through another hour? Or do you really love the coffee from that particular shop, and deliberately planned the trip?

If it was a mindless coffee grab, think back to how you felt. Maybe you realize that it wasn’t the best way to have dealt with that situation. Maybe those coffees (while providing a stress break) didn’t really bring you any happiness. Mark a negative (-) beside them to show that you want to decrease these purchases.

But if you love that shop’s coffee, you may feel that level of expense is fine and leave it there. If so, mark it with an equal (=) sign for no change.

Perhaps you felt really happy about the purchase because it was a relaxing break. You had a chance to hang out with friends, and you really love the aroma and taste of that coffee. You might even decide you’d like to increase that level of happiness in your life! If so, mark it with a plus (+) sign.

You continue doing this with each transaction and ultimately, each category, until every transaction has been “rated” as positive, negative, or neutral.

Finally, go back to the financial Net Worth you calculated at the very beginning and do the same with each of the items you listed there. Some things may already have become obvious as part of bringing consciousness to your finances on a monthly basis.

You may have realized you’re not happy with how much you spend on debt payments, and you don’t have the extra money that you need in order to increase some expenses that do bring you happiness. If this is a case, you need to rebalance your finances to lower your debt payments and increase the other expenses; this may require speaking to a professional about your debt.

Maybe you are unhappy with your home and want to move to a place that allows you to be happier. This may involve buying a larger home, moving to a different location or even downsizing from a large apartment to a smaller one and getting rid of excess stuff.

Maybe you recognize your current sources of income actually makes you unhappy, and you want to move towards other sources that would bring you more happiness.

The shift in mind set

As you apply these principles to your finances, you will start to see a shift in your actions on a day-to-day, week-to-week and month-to-month basis with decisions that move you towards being happier.

Once you bring consciousness to your finances, you can’t unknow them. You can choose to ignore them, but that in itself is a conscious choice about your finances, just not one that brings you closer to happiness.

Conclusion

As a summary of the steps you take to bring consciousness to your finances:

- At the basic level of bringing consciousness to personal finances, you start with becoming aware of your finances by establishing your net worth and tracking your income and expenses.

- At month’s end, you evaluate and rate your transactions as you remember how much happiness each brought you.

- Lastly, you adjust your actions to move towards happiness.

In the end, we all just want to be happy and we all have to choose our own ways of getting there. The level of consciousness you wish to bring to your finances is your choice. Using the processes described in this post may help you do that, but really it is about doing what works for you because, ultimately, it is about your happiness.

We’d love to hear if you found this post helpful! Please let us know by dropping a comment below.

And if you’d like some personal assistance on how to bring consciousness to your finances, please contact us….as certified Lifebook Leaders, we love helping others move forward in creating a life they love!

Caution: The information contained in this article is in no way intended to eliminate the need for you to seek professional financial assistance. If anything, as you bring consciousness to your finances, you may realize that you need professional assistance in order to achieve your financial goals. We encourage you to seek any assistance you may need.